In April 2025, Tesla’s UK sales experienced a significant decline, with only 512 vehicles sold—a 62% drop compared to the same month in the previous year. This downturn coincides with the implementation of new vehicle tax regulations and growing competition in the electric vehicle (EV) market. This article delves into the factors contributing to Tesla’s sales slump, the impact of tax changes, and the broader implications for the UK’s EV landscape.

A. Overview of the UK EV Market in 2025

1. EV Sales Trends

Despite Tesla’s decline, the UK’s overall battery electric vehicle (BEV) market saw an 8.1% increase in April 2025, capturing a 20.4% market share. However, this growth falls short of the government’s target of 28% for the year. The Society of Motor Manufacturers and Traders (SMMT) has adjusted its forecast, anticipating a 23.5% market share for BEVs in 2025.

2. Rise of Plug-in Hybrids

Plug-in hybrid vehicles (PHEVs) have gained popularity, with sales increasing by 34% in April to 14,000 units. PHEVs now represent nearly 10% of the market, offering consumers a transitional option between traditional combustion engines and fully electric vehicles.

B. Factors Contributing to Tesla’s Sales Decline

1. Taxation Changes

The UK government introduced significant tax reforms affecting EV owners starting April 1, 2025:

-

A. Vehicle Excise Duty (VED): Previously exempt, all EVs now incur a VED of £10 in the first year and £195 annually from the second year onwards.

-

B. Expensive Car Supplement (ECS): EVs with a list price over £40,000 are subject to an additional £425 annually for five years, totaling £2,125.

These changes have increased the cost of owning a Tesla, as most models exceed the £40,000 threshold.

2. Consumer Behavior

Anticipating the tax changes, many consumers expedited their EV purchases before April, leading to a surge in sales in March and a subsequent drop in April.

3. Competition from Chinese Manufacturers

Chinese automakers have made significant inroads into the UK market:

-

A. BYD: Achieved a 654% increase in UK sales, reaching 2,511 vehicles in April.

-

B. Jaecoo and Omoda: Surpassed Tesla’s sales with 1,053 and 910 units sold, respectively.

These brands offer a mix of electric, hybrid, and combustion vehicles at competitive prices, appealing to a broader consumer base.

4. Public Perception of Elon Musk

Tesla’s CEO, Elon Musk, has faced criticism for his political affiliations, including support for controversial figures and policies. This has led to public backlash, protests, and even vandalism of Tesla vehicles in Europe, potentially influencing consumer sentiment.

C. Impact on Tesla’s Market Position

1. European Market Challenges

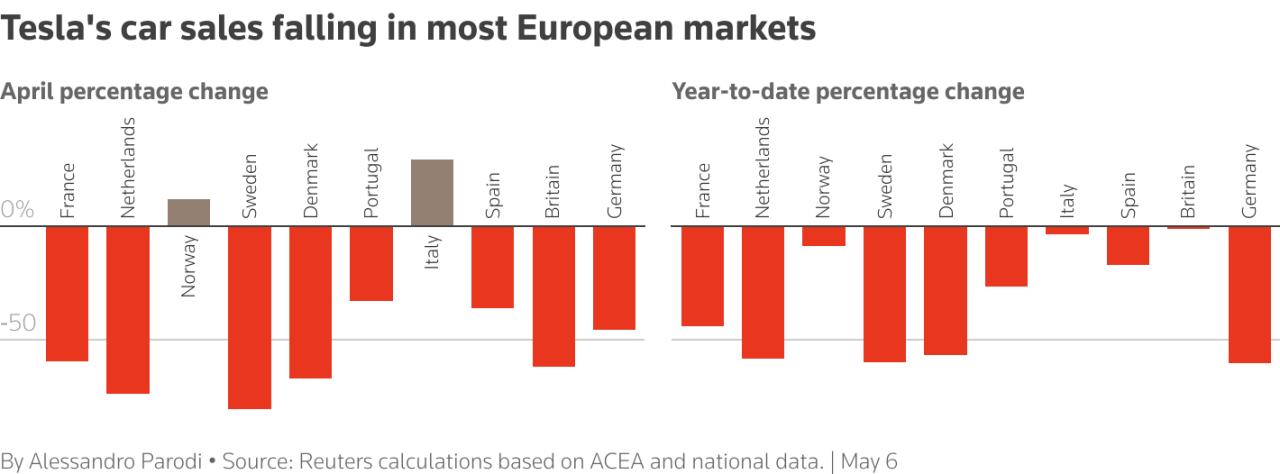

Tesla’s struggles are not confined to the UK. In Germany, sales dropped by 46% year-over-year in April. Similar declines have been observed in Spain, Belgium, and Sweden, with reductions ranging from 55% to 81%.

2. Stock Performance

Reflecting these challenges, Tesla’s stock has fallen by over 30% since the beginning of the year, with a 2% drop reported recently due to ongoing sales declines in Europe.

D. Industry Response and Future Outlook

1. Calls for Policy Revisions

Industry leaders, including the SMMT, have urged the government to reconsider the new tax policies, arguing that they may hinder the adoption of EVs and the achievement of environmental goals.

2. Potential Government Adjustments

The government has acknowledged the disproportionate impact of the ECS on EVs and may consider raising the £40,000 threshold for zero-emission cars in future fiscal events.

3. Tesla’s Strategic Moves

In response to declining sales, Tesla has offered incentives such as two years of free Supercharging on select models to attract customers.

Tesla’s significant sales drop in the UK highlights the complex interplay between taxation policies, consumer behavior, market competition, and corporate reputation. As the EV market continues to evolve, manufacturers and policymakers must navigate these challenges to promote sustainable transportation effectively.